- Home /

- Investor strategies

- /Tax aware investing

Next article

08 November 2024 • 27 min read

Breaking down Division 296 tax

breaking down division 296 tax1

Categories:

08 November 2024 • 27 min read

Superannuation remains a highly tax-effective way for most Australians to save for retirement, offering concessional tax treatment of contributions and favourable tax rates on earnings within the structure. However, the proposed superannuation Division 296 tax on earnings of balances above $3 millionᵃ requires careful consideration when developing financial planning strategies.

Generation Life’s Not Tomorrow’s Problem Guide has indicated that almost 4 in 5 Australians don’t have a strong understanding of any upcoming superannuation tax concession changes, which is concerning.ᵇ With superannuation account balances increasing and no plans for indexation of the $3 million threshold any time in the future, Division 296 has the potential to impact many more superannuation members than the approximately 80,000 set to be impacted in 2025/26 financial year.ᶜ

“The proposed Division 296 changes provide a dual problem. I believe most people don’t know what they are, and they also have the potential to have the greatest impact on the population.” – Ben Nash, Financial Adviser and Founder at Pivot Wealth

Superannuation Division 296 tax - what does this mean?

This proposed change to the superannuation concessions with the introduction of Division 296 tax, means that from 1 July 2025, Australians will be subject to an additional 15% tax on calculated earnings (including realised or unrealised gains) where Total Superannuation Balances exceed $3 million.

The $3 million Total Superannuation Balance threshold is based on balances adjusted including for contributions and withdrawals made throughout a financial year, but will not be indexed or adjusted for inflation over time. Having no indexation may mean that over time, as superannuation balances grow due to investment returns and contributions, more Australians find themselves subject to this tax.

Australians should seek appropriate advice to confirm whether investing into superannuation once the $3 million threshold is reached or likely to be reached, is still the most tax-effective investment strategy. It’s also very complex to calculate exactly how much additional tax a superannuation member will need to pay on earnings on balances above $3 million.ᵈ

This is a concern Mid and High-Net-Worth investors may need to prepare for, as a combination of wage growth, earnings and non-concessional contributions could push their Total Super Balance beyond the $3 million threshold before they retire.

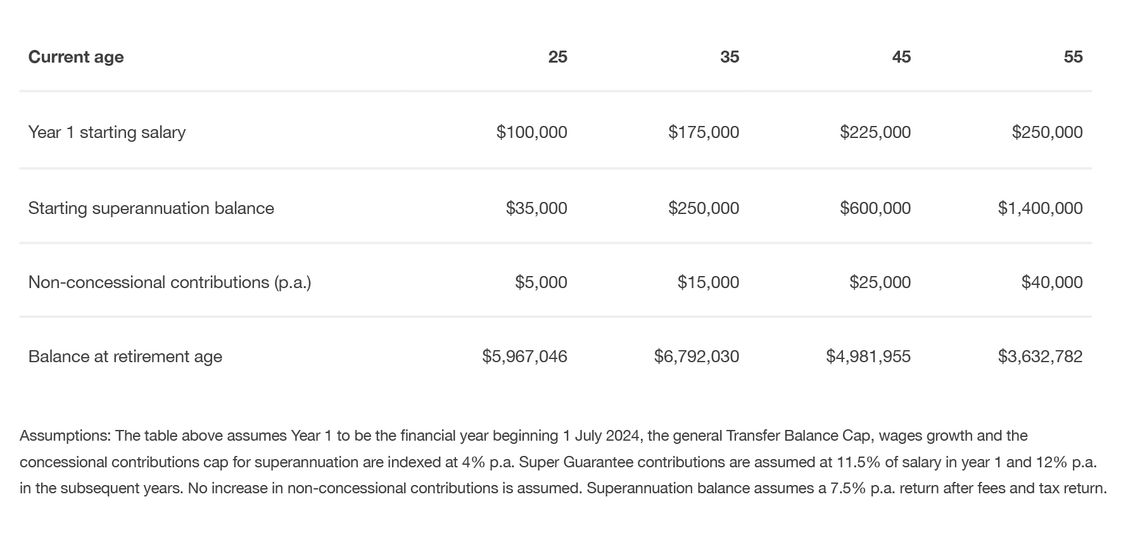

Have you considered the potential impact of the Division 296 tax on your superannuation balance?

Planning ahead… The possible future $3m Division 296 threshold issue for various age cohorts at the retirement age of 65.

division 296 tax table

A tax-effective structure

Australians are now turning to structures, such as investment bonds, to help reduce the expected impact of the proposed Division 296 tax on earnings on Total Superannuation Balances above $3 million.

Investment bonds are a tax-paid structure and can help you achieve your medium and long-term goals, whether that’s looking to reduce the impact of the proposed Division 296 tax on earnings on superannuation balances above $3 million, create wealth or pass onto the next generation.

Generation Life investment bonds can complement super by providing benefits such as, having the ability to access money at any time, more control and certainty when passing on wealth, with no superannuation death benefit tax when paying to non-dependants. Investment bonds can be structured to be passed on or paid out tax-free upon death regardless of who the beneficiary or beneficiaries are.

Tax Optimisation through our unique investment bond structure

Investment bonds are taxed at a maximum rate of 30% but depending on the investment options chosen within the unique investment bond structure, the long-term effective tax rates can be as low as 10%-15%.ᵉ Governed by life insurance and tax legislation, investment bonds have benefited from a consistent legislative framework and environment designed to facilitate both the accumulation and distribution of wealth.

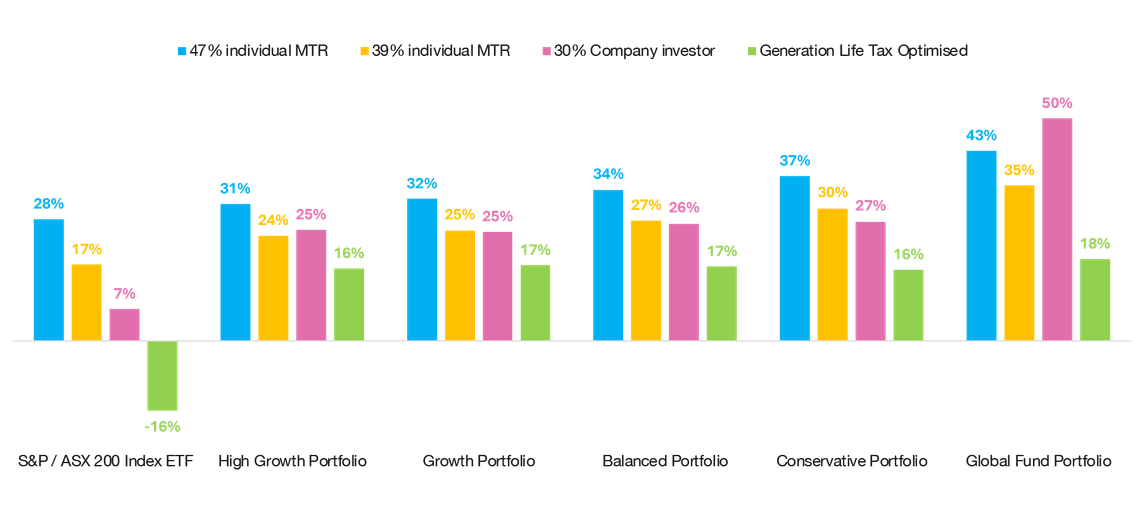

Example: Comparing effective tax rates for different asset classes

comparing effective tax rates for different asset classes

The graph above compares the actual annual effective tax rates on earnings by different tax structures between the 2019 financial year and 2023 financial year. Past based performance and rates is not an indication of future performance and rates.

Generational Wealth

Tax can impact not just one generation but future generations as well.

Based on proposed legislation, the objective of superannuation is “to preserve savings to deliver income for a dignified retirement, alongside government support, in an equitable and sustainable way”.ᶠ Generation Life’s Reimagining Legacy 2023 Guide however revealed one in three Australians believe super is the best way to optimise wealth and leave a legacy, despite this not being its purpose.ᵍ Earlier this year, Minister for Financial Services, Stephen Jones, stated that the purpose of super is to provide for retirement income. “It strikes me as odd in a system which is about retirement income that a third of the cheques written by superannuation fund[s], by value, are bequests,” he told ABC News Breakfast. “It’s not the purpose of superannuation to have a tax preferred, estate planning mechanism. It’s for providing for people in their retirement.”ʰ

Under current legislation, the tax treatment of superannuation death benefits varies depending on whether it is paid out as a lump sum, an income stream, or a mix of both, and if the intended beneficiaries are considered ‘dependants’ or ‘non-dependants’ for tax purposes.ᶦ

Lump sum superannuation death benefits paid to a dependant, like a spouse, child under 18, financially dependant person, or those in an interdependency relationship are paid out tax-free. However, any lump-sum death benefits paid to ‘non-dependants’ may be subject to tax of up to 15% plus the Medicare levy on the taxable component, reducing the size of the legacy left behind.ʲ

Furthermore, the proposed Division 296 tax on earnings on total superannuation balances above $3 million has sparked new debate around whether superannuation is the optimal structure to accumulate and transfer wealth.

Beyond their role in wealth accumulation, Generation Life Investment Bonds serve as an invaluable tool for estate and succession planning. They can be structured as non-estate assets where beneficiaries are nominated, and can bypass the estate and the need for probate.

Generation Life Investment bonds offer a streamlined approach to wealth transfers that minimises delays and the administrative burdens typically associated with the distribution and finalisation of deceased estates.

Additionally, the flexibility to control when and how beneficiaries receive inheritances, with the added layer of protection in the event of bankruptcy of the owner, further enhances the appeal of Generation Life’s Investment Bonds for transferring wealth across generations.

Find out more

At Generation Life, we have been at the forefront of innovating the tax-effective investing landscape through a new generation of investment bonds for over 20 years. We are proud to be helping secure the financial futures of many Australians and their families.

If you’re a financial adviser looking for ways to help your clients with tax-effective investments, contact one of our Distribution and Technical team members to find out more.

Download our latest research

Generation Life recently launched the Not Tomorrow’s Problem Guide – a comprehensive resource for financial advisers, providing valuable insights into Australians' financial motivations, goals, and the barriers preventing them from achieving their financial dreams.

Uncover the latest data, gain insights from industry experts and explore innovative investment solutions designed for Australians at every life stage.

If you're a financial adviser, download your copy today.

Footnotes:

a. Treasury Laws Amendment (Better Targeted Superannuation Concessions and Other Measures) Bill 2023 and Superannuation (Better Targeted Superannuation Concessions) Imposition Bill 2023

b. Generation Life Not Tomorrow’s Problem Guide, published October 2024

c. Prime Financial Group: DIVISION 296: Criticism & SMSF Stressors Regarding the $3 million Super Tax: https://www.primefinancial.com.au/blog/division-296-criticism-smsf-stressors-regarding-the-3-million-super-tax

d. Jacobson, R., ‘Taxing unrealised gains in superannuation under Division 296,’ https://www.smsfadviser.com/strategy/23353-taxing-unrealised-gains-in-superannuation-under-division-296 on 5 April 2024

e. Indicative effective average tax rates for growth focused Tax Optimised investment options. The effective average tax rates represent the estimated average annual tax as a percentage of earnings for each 12-month period over a period of 15 years. Actual tax amounts payable are not guaranteed and may vary from year to year based on the earnings of an investment option.

f. Superannuation (Objective) Bill 2023

g. Of high-net-worth Australians as described in Generation Life Reimagining Legacy Guide 2023

h. Minister for Financial Services, Stephen Jones - ABC News Breakfast – 2024. Source: https://www.superreview.com.au/news/financial-advice/australians-still-relying-super-wealth-transfer

i. See section 302-195 of the Income Tax Assessment Act 1997

j. Australian Taxation Office, ’Paying superannuation death benefits,’ published on http://ato.gov.au on 18 June 2024