Stop your investment returns being consumed by tax

genlife water 3 cwebbanner4

Tax awareness is critical to maximising investment returns. Many investors are swayed by headline performance figures that ignore the bite tax will take. Investments aren’t generally set up to be managed in a tax effective or tax aware fashion. Not ours.

Investment returns go up when your tax goes down

It becomes increasingly apparent over time that an investment’s tax position makes a huge difference to the end returns for an investor. This is particularly true in Australia where rules for such things as imputation credits and capital gains apply.

Many investors see superannuation as the most tax effective investment vehicle available to save for long-term wealth. But with favourable tax concessions disappearing or being restricted there’s a growing need to find an alternative way to achieve superior after tax returns. That’s why we focus on outthinking today.

Generating tax effective investments for you

Generation Life has helped Australians with tax effective investment solutions for over 17 years. Our latest share strategy delivers superior after-tax returns to Australian investors. In fact, we anticipate a long-term tax rate as low as 9 – 11%*.

We offer:

- An Australian shares ‘index plus’ strategy designed to provide long-term capital growth.

- A tax-aware trading and implementation approach to deliver superior after-tax returns by reducing transaction and taxation costs.

- A transparent, rules-based actively managed portfolio focused on delivering lower volatility with a risk profile that matches the Australian share market index.

rectangle4

rectangle4

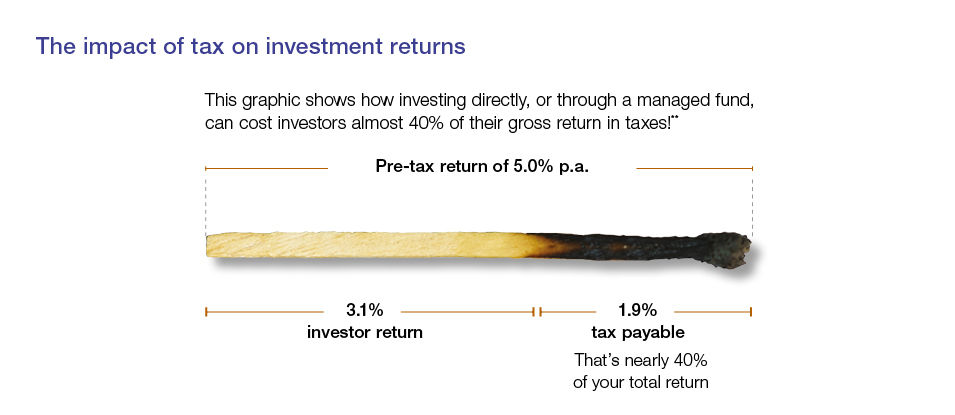

The graphic below shows how investing directly, or through a managed fund, can cost investors almost 40% of their gross return in taxes!**

Impact of tax on investment

* Expected long-term effective tax rate paid by the fund is in the range of 9-11%. The actual effective tax rate may vary and future performance and effective tax rates are not guaranteed.

** Illustrative annualised return profile for a portfolio of Australian shares, invested over a 20-year period, with indicative tax paid on the assumption of a 47% marginal tax rate (including levies) and assumed reinvestment of dividends and/or distributions. This includes the effect of any imputation credits and realised gains discount rules applicable over the period but does not include the impact of fees. This does not represent any actual or forecast returns. Source: Redpoint Investment, Generation Life.

rectangle4

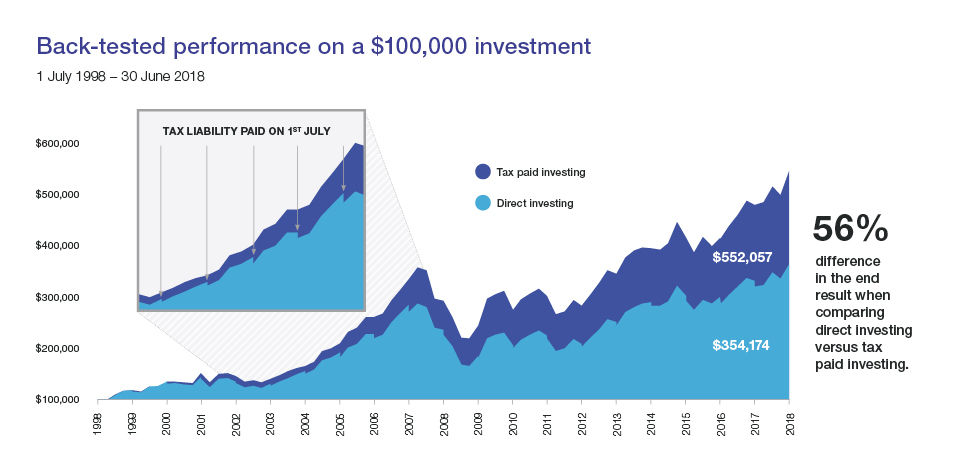

Enhancing your long-term returns after tax

This chart simulates the performance of the Generation Life Tax Effective Australian Share Fund over a 20 year period prior to the fund’s launch.

It uses the example of an individual investor on a 47% marginal tax rate, (including levies) to compare the fund’s returns with anticipated returns from an Australian shared index fund. As you can see, the fund’s expected long-term average tax rate of 10% has a dramatic and positive effect on the eventual return of the investment. All without additional investment risk.

Effect of cost of tax to returns

Based on back-tested strategy for a 20 year period to 30 June 2018 on an after fees basis and assumes index investment management cost of 0.29% p.a. and Generation Life Tax Effective Australian Share Fund investment management cost of 0.65% p.a. For illustrative purpose only. Compounding returns assuming reinvestment. Past performance not indicative of future performance. Assuming a marginal tax rate of 47% (including levies) when investing directly versus effective tax rate of 10% through tax paid investing.

Back-tested performance is not an indicator of future actual performance. This is a new fund with no actual performance history. Chart and performance returns are provided for illustrative purposes and reflects hypothetical historical performance and assumptions which may or may not be tested and subject to loss. Please see the Performance Disclosures at the end of this document for more information regarding the inherent limitations associated with back-tested performance.

rectangle4

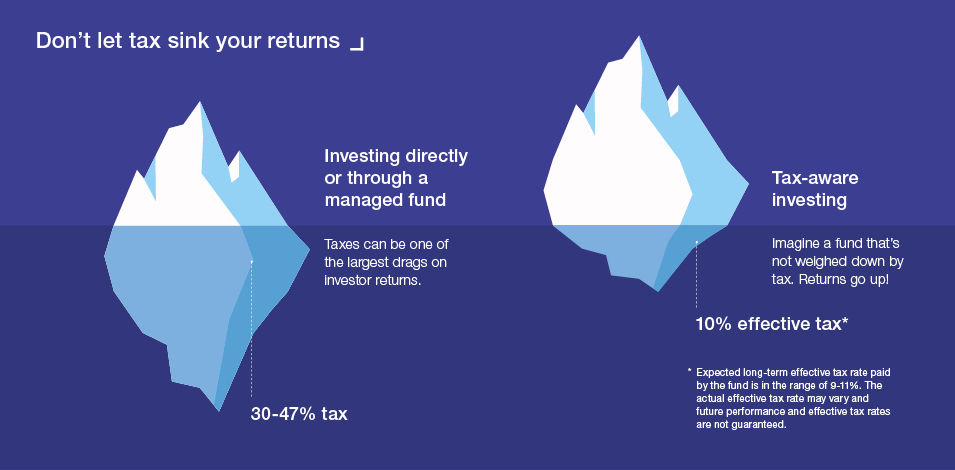

Investing directly or through a managed fund vs tax aware investing

Don't let tax sink your returns

Managing after tax returns without increasing risk

The key to success lies in managing after tax outcomes without adding additional risk. Typically, a number of opportunities to do this will present themselves along the investment journey. For example, an astute investor might improve an after tax return by delaying the sale of an asset until the following financial year.

Or they might choose to sell one of two identical assets knowing that the tax cost of doing so would be less, but will have no impact on the portfolio’s risk profile. Our tax-aware philosophy takes a very similar approach.

The Generation Life Tax Effective Australian Share Fund seeks to control tax outcomes through smart trading that does not incur additional levels of risk.

rectangle4

Tax management by design

Tax effective portfolio management

Every investment decision is carefully considered to ensure the most tax effective trading outcome. Whether it’s a stock purchase or sale, the investment manager employs a systematic and measurable approach to secure the most tax efficient trade.

A typical managed fund has to balance the interests of its many different, tax-paying investors. In contrast, the Generation Life Tax Effective Australian Share Fund’s investment manager needs only to consider the tax position of the fund as a whole. This simplification makes achieving the most tax-effective position far easier.

Lower portfolio turnover

There are two significant benefits of the strategy we employ to reduce stock turn over (the less frequent trading of stocks). Firstly, our fund incurs lower trading and transaction costs (e.g. brokerage fees). Secondly, fewer capital gains events mean fewer tax events. With tax paid less often; funds stay invested for longer with the benefit of compounding that leads to improved returns.

rectangle4

How we help build your wealth

The Fund invests in Australian shares in a tax aware manner with an ‘index plus’ approach. This strategy provides low-cost active management and seeks to exceed the S&P/ASX200 Accumulation Index modestly over the long term.

The Fund’s structure and strategy may be suitable for you if you need a:

- core Australian share allocation within a diversified portfolio of managed investments

- low cost, low volatility alternative to actively managed Australian share funds

- tax effective alternative to holding Australian shares directly or through a managed fund

- way to manage the level of distributable income and tax paid.

rectangle4

Simplicity, innovation and value

Generation Life has led the way in providing innovative investment solutions for over 16 years with over $1.5 billion invested with us to date. We focus on simplicity and value and specialise in tax effective solutions that deliver down the line.

“Let’s outthink today together.”

rectangle4

Discover how to achieve better investment returns

To find out more about how tax aware investing can help achieve better investment returns, please download our Tax Effective Australian Share Fund brochure.

Ready to invest?

Start investing now and kick start your investment journey by using our secure and easy to use online application form, which allows you to save your progress at anytime. Alternatively, please contact us or email us at enquiry@genlife.com.au

rectangle4

Performance disclosure

Illustrative performance returns for the fund do not represent actual performance. The performance information presented represents back-tested performance based on simulated data results from 1 July 1998 to 30 June 2018 using the Generation Life Tax Effective Australian Share Fund strategy and investment approach with annual rebalancing on the first of each financial year and the effect of fees, charges and investment bond taxes. Back-tested performance is hypothetical (it does not reflect actual trading) and is provided for informational purposes only to indicate historical performance had the fund been available over the relevant time period. There are limitations inherent in back-tested results, particularly that returns do not reflect actual trading and may not reflect the impact that material economic and market factors may have had on the fund manager’s decision-making had the fund manager actually managed the fund. Back-tested performance also differs from actual performance because it is achieved through the retroactive application of portfolios designed with the benefit of hindsight. As a result, the portfolio theoretically may be changed from time to time and the effect on performance results and tax rates could be either favourable or unfavourable. Past performance is not an indication of future performance.

Generation Life Limited (Generation Life) AFSL 225408 ABN 68 092 843 902 is the product issuer. The information provided is general in nature and does not consider the investment objectives, financial situation or needs of any individual and is not intended to constitute personal financial advice. The product’s Product Disclosure Statement (PDS) and Target Market Determination are available at www.genlife.com.au and should be considered in deciding whether to acquire, hold or dispose of the product. Professional financial advice is recommended. The offer made in the PDS is only available to persons receiving the PDS in Australia. Generation Life excludes, to the maximum extent permitted by law, any liability (including negligence) that might arise from this information or any reliance on it. Past performance is not an indication of future performance.